Resources for Businesses

Contractors & Rhode Island Tax - A Guide for Businesses

The Restaurant Industry & Rhode Island Tax - A Guide for Businesses

The Hotel Industry and Rhode Island Tax - A Guide for Businesses

In accordance with changes signed into law in June of 2022, a larger business registrant will be required to use electronic means to file returns and remit taxes to the State of Rhode Island for tax periods beginning on or after January 1, 2023. Visit our Electronic Filing Mandate page for more information on this requirement.

Business Taxes

Here is some information on the more common taxes that impact businesses

Depending on the entity type of the corporation running the business, either a minimum fee of $400 or a tax of 7% on the income of the corporation is due annually. Please visit our Corporate Tax webpage for more information.

As an employer you are required to pay certain employer taxes on behalf of your employees. Please visit our Employer Tax webpage for more information.

If your business is a pass-through entity with one or more non-resident members, a pass-through entity return is required to be filed and the appropriate tax paid on the income of the non-residents. Please visit our Pass-through income webpage for more information.

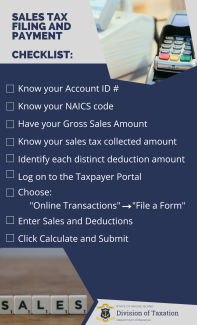

If you make sales at retail, your entity is required to collect and remit one or more taxes.

- a 7% sales tax is due on all taxable sales made by your business

- a 1% local meals and beverage tax is due on food sales

- a 6% hotel tax is due on hotel room rentals

Please visit our Sales and Excise Taxes for Businesses webpage for more information.

The wages earned by you and your employees are subject to Federal and state withholding. Please visit our Withholding Tax webpage for more information.

Additional Information

Here are some commons topics related to businesses.

If you are interested in starting a new business, here are some helpful links

Apply for an Employer Identification Number (EIN)

Rhode Island Business Application

Unemployment Insurance (UI) for Employers

If you are interested in closing a business, be sure to file an Account Cancellation Form with us to prevent assessment of additional taxes in the future.

If you need a Letter of Good Standing, more information can be found on our Letter of Good Standing webpage.

For help determining if you have nexus in Rhode Island, please review the Managed Audit Nexus Questionnaire found on the Audit Forms page.

Go to our Registration page for registration options and additional information.

Please contact us with any additional questions via email tax.registration@tax.ri.gov or by phone 401.574.8938.